Project information

Project Details

In this project, I have investigated and applied the mathematical and statistical methods within DSP and ML disciplines to interpret and forecast stocks' price.

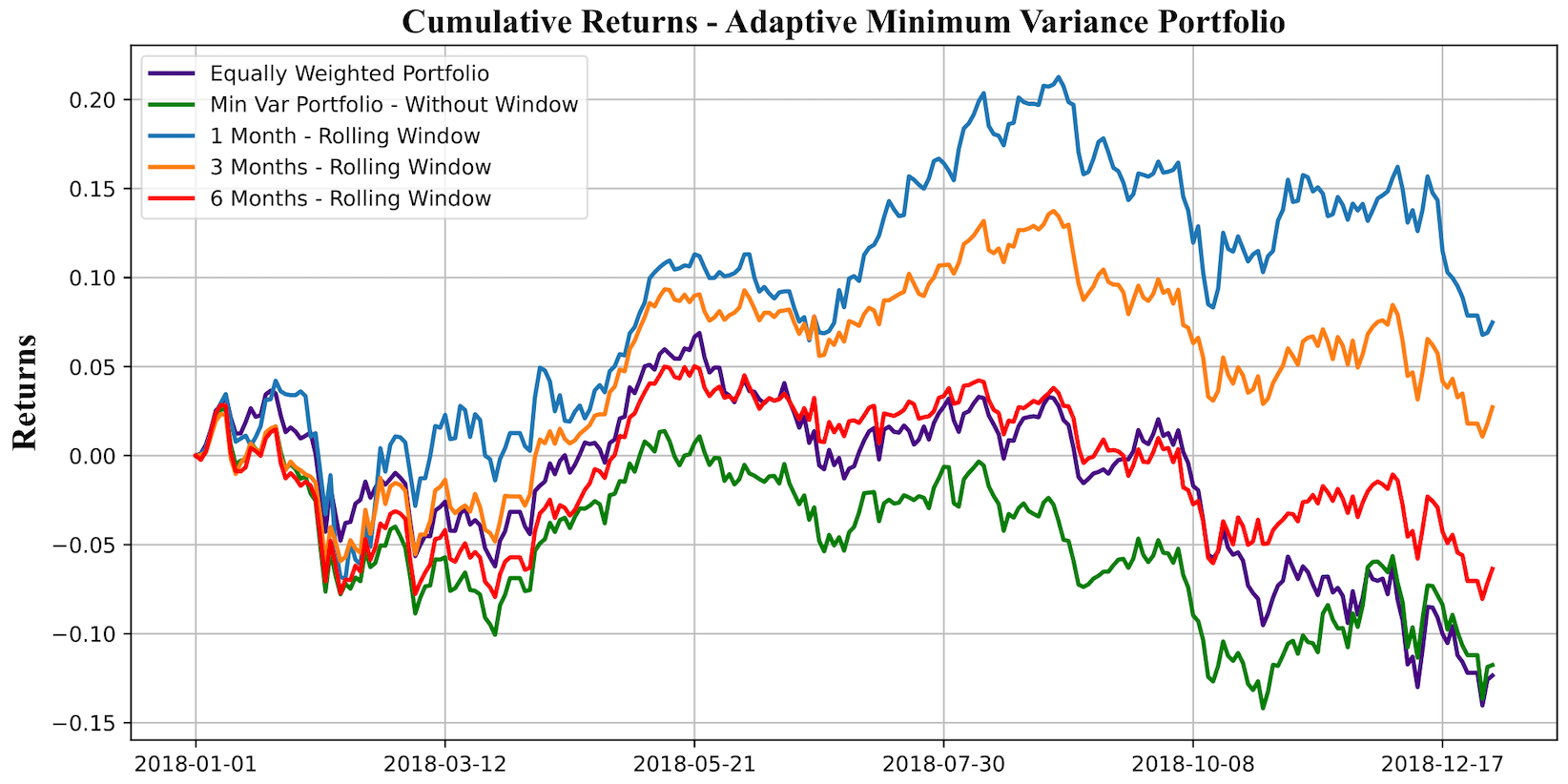

In the report, ARMA and ARIMA models are tested to compare their performance in predicting stock price. Under bond pricing section, differences between compounding under different intervals such as annually and monthly are explored. Not only that, Macaulay duration, modified duration and Arbitrage Pricing Theory are studied and discussed in the report. I also applied adaptive minimum-variance portfolio optimisation method on selected stocks’ data and compared its performance against equally weighted portfolio. Apart from that, areas like robust statistics and graphs in finance are also investigated.

Report Content

- Regression Methods

- Bond Pricing

- Portfolio Optimisation

- Robust Statistics and Non Linear Methods

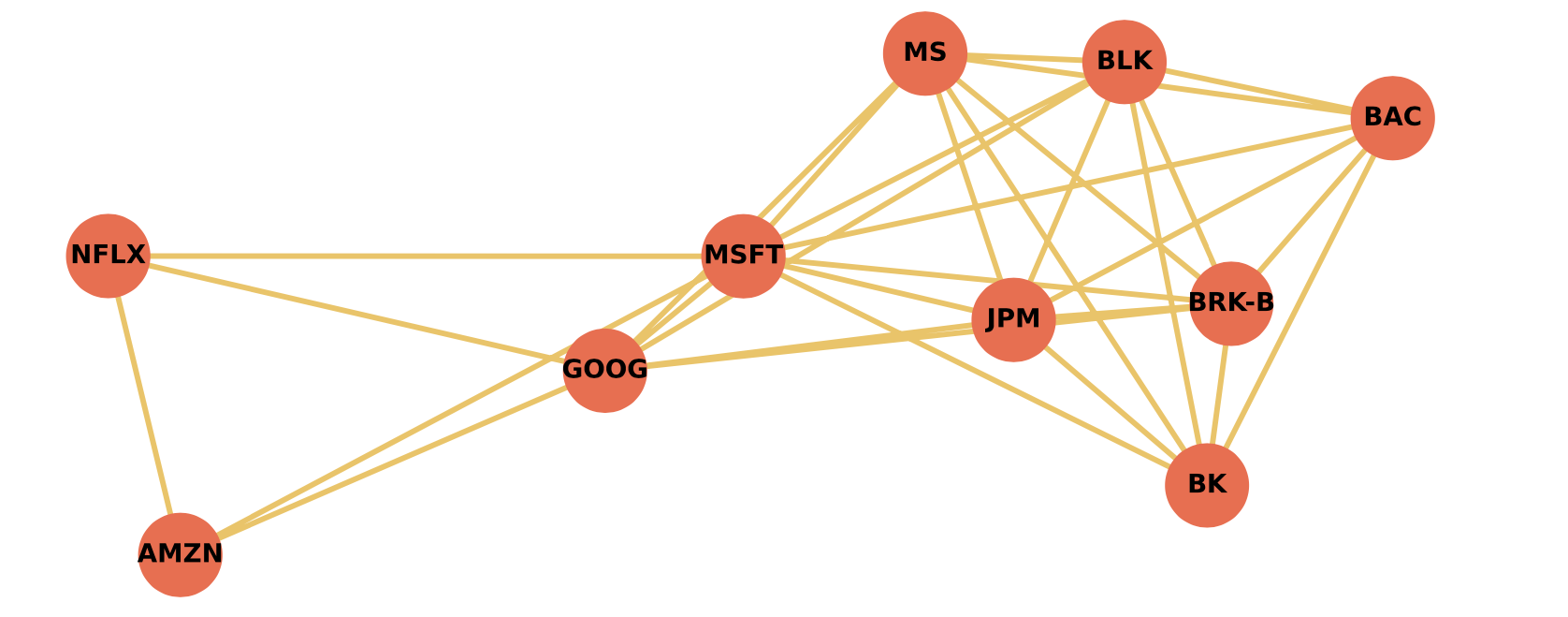

- Graphs in Finance